Every year, March is designated Women’s History Month. In this month, we honour and celebrate women’s contributions to history and contemporary society. In today's blog, we talk with women from our FEM program, and they highlight the roles they play in their families and Kasese community. Read the blog article to learn more!

What is Mobile Money?

Accessible Banking for the Rural Malawian Poor

Mobile money will change what is possible for the rural poor.

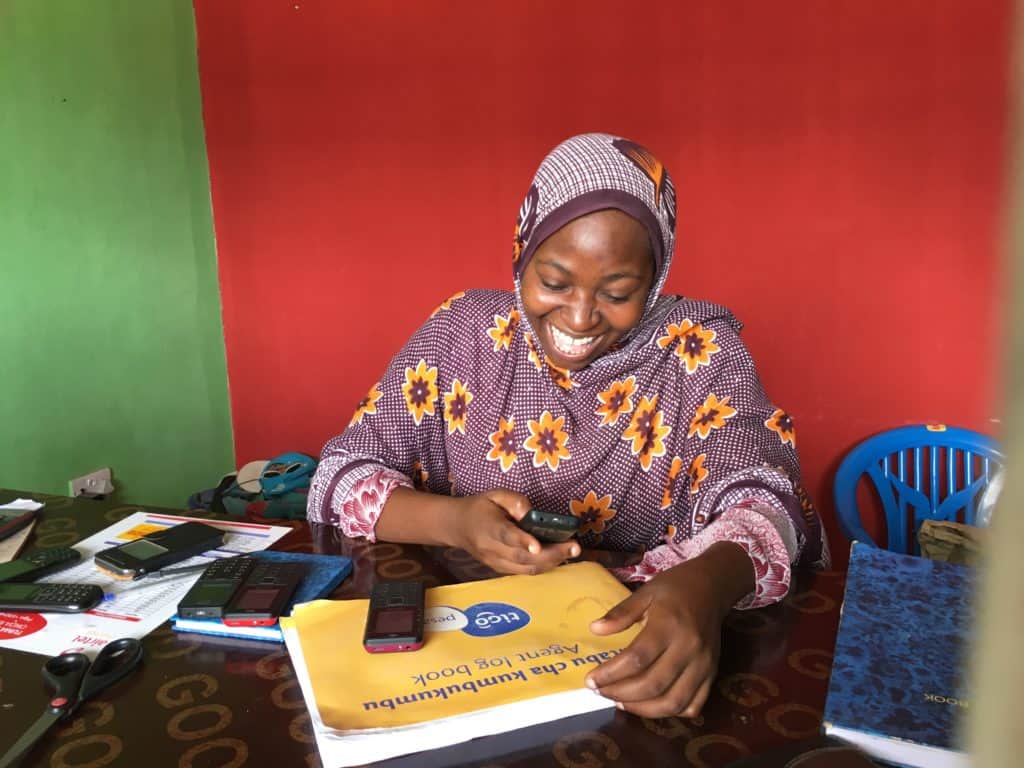

Orant is excited to promote the use of mobile money. Especially in our Financially Empowering Microloans (FEM) for Women Program.

Orant’s FEM for Women Program supports 15 women. We provide no interest loans to aid in their business ventures. In the past, Orant exchanged manual cash loans. This meant FEM for Women participants had to travel to Orant’s campus to collect and repay loans. It also meant they had to carry cash when travelling. This year, Orant has transitioned to electronic transfers. As a result, women don’t have to leave their place of business to repay their loans. They can do it from their mobile phones.

What is mobile money?

Banking via cellphone. People can send and receive money, pay bills, and transact with other banks. All from the convenience of a mobile phone. Since the technology is installed in a SIM card, it doesn’t require internet. It also doesn’t require affiliation with a formalized bank. This is game-changing for the rural poor.

Benefits of Mobile Money:

- Accessibility

Money can be transferred almost everywhere. Including hard to reach rural areas with no formal banks. Mobile money agents provide person-to-person contact. In other words, they train those who are unfamiliar with the technology.

- Financial Security

Mobile money allows for cashless payments. This lessens risks of cash handling. Ie: loss, theft, fraud.

- Low Transaction Costs

Compared to bank charges, mobile money platforms have low transaction costs.

- Time Saving

People can access money services without travelling long distances. Or standing in lines. They can also safely send money to family members who are geographically distant.

What Mobile Money Means for Women in Malawi

Agency. The freedom to manage their own financial lives. It means they, not their husbands or fathers, can choose how to spend their hard-earned money. Why is this important? Studies in Kenya showed that access to mobile money increased household consumption and savings. Therefore, it reduced poverty. And (drumroll, please) the effects were largest in female-headed households.

For many women, there’s still a learning curve.

Managing finances is new. Mobile money is even newer. Orant is here to help with that. By requiring mobile money for loan transfers, Orant incentivizes women to use it. We also provide training and support with the help of Hey Sister, Show Me the Mobile Money.

When women have access to technology like mobile money, the impact is immense.

The Orant Journal

Celebrating 5 Years of FEM for Women

Learn how to make this favorite Malawian dish, Mpiru Otendera. One of Malawi’s most popular recipes, Mpiru Otendera (mustard greens with peanut flour) is a nutritious and filling recipe that goes well with many meals.

Transforming the Lives of Women in Rural Malawi

In rural Malawi, pregnant women face many challenges including lack of access to prenatal care, poor nutrition, and lack of safe spaces to deliver their babies. Orant is working to change that with the renovation of our maternity ward. Read about it in this week’s blog.

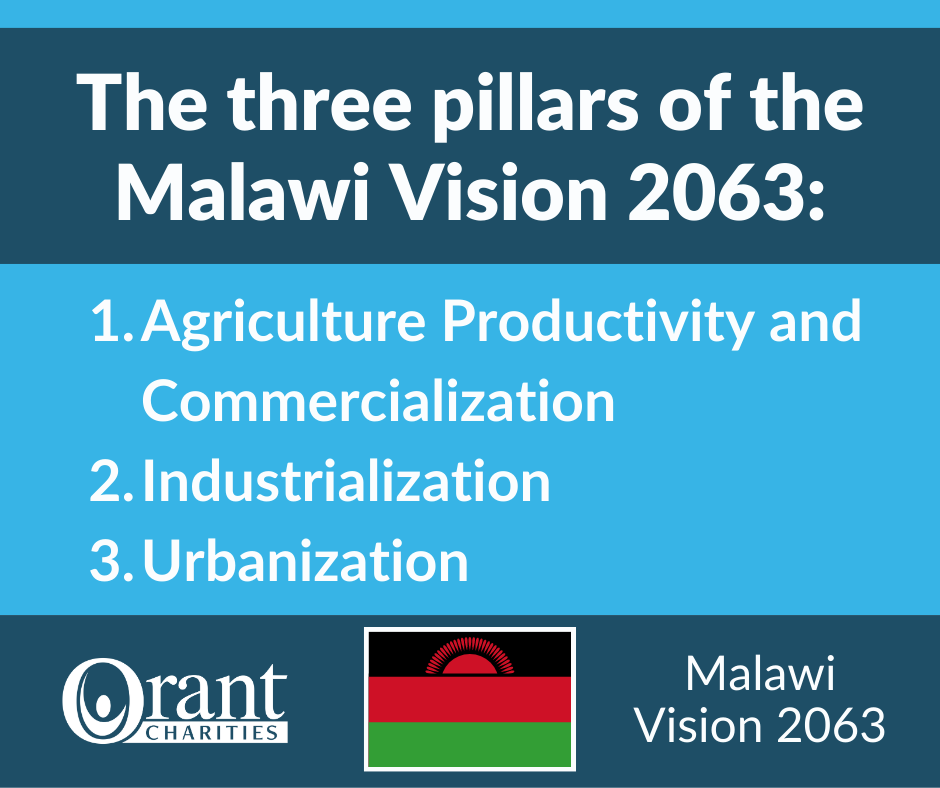

What are the Malawi Vision 2063 Pillars

Malawi Vision 2063 aims to transform Malawi into a prosperous, self-reliant, inclusively wealthy and industrialized country by the year 2063.

What is Malawi Vision 2063

Malawi Vision 2063 aims to transform Malawi into a prosperous, self-reliant, inclusively wealthy and industrialized country by the year 2063.

Growing Malawi’s Economy through Orant’s FEM Program

Read our latest blog to learn more about how our Financial Empowering Microloans (FEM) for Women program serves the Kasese community and helps to lift a heavy burden off the community’s shoulders.

Making Dreams into a Reality: Orant’s Microloan Program in Malawi

Many women in rural Malawi find themselves stuck in the poverty cycle due to lack of business capital. Our FEM Program works with such women, helping them transform their lives as they become independent. Learn more in our latest blog as Sophelet’s shares her story.

Microloans and Building Business Skills in Malawi

At the end of 2022 we introduced our third group of our Financial Empowering Microloan (FEM) for Women group called Takondwa. Read our latest blog, as Magret Moffat, one of the group's beneficiaries, tells a story of how the program has already transformed her life through loans and business skills training.

Cultivating a Savings Culture in Malawi

As a way of cultivating a saving culture in the FEM Program, Orant requires each cohort to establish a savings group. Why is this important? Find out here.

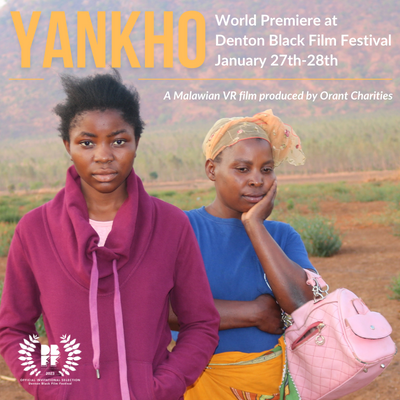

Yankho: A Virtual Reality Film from the Warm Heart of Africa

In Orant's first ever Virtual Reality film, a Malawian mother’s dreams for her daughter are altered by the challenges of rural s poverty.